How Much Car Insurance Cost on a Lexus 2016

2016 Lexus IS 300 Insurance Rates

Enter your zip code below to view companies that have cheap auto insurance rates.

| Jeffrey Johnson graduated summa cum laude from the University of Baltimore School of Law and has worked in legal offices and nonprofits in Maryland, Texas, and North Carolina. He has also earned an MFA in screenwriting from Chapman University and worked in film, education, and publishing. His professional writing has appeared on sites like The Manifest and Vice, and he is the author of a novel ... Full Bio → | Written by |

UPDATED: Dec 18, 2019

Advertiser Disclosure

It's all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don't influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

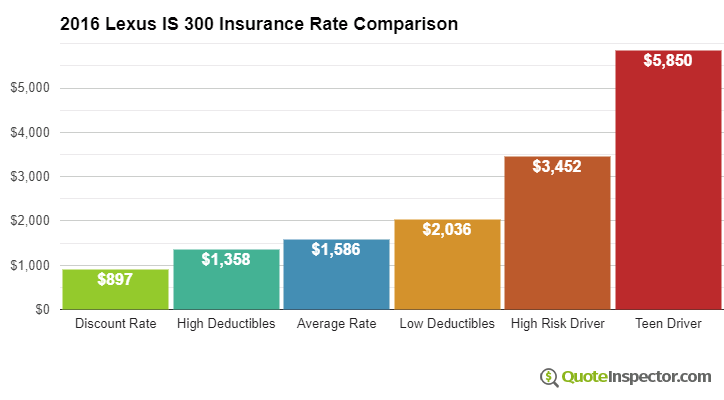

Average insurance rates for a 2016 Lexus IS 300 are $1,532 a year including full coverage. Comprehensive insurance costs around $314, collision costs $618, and liability costs around $442. Buying a liability-only policy costs as low as $496 a year, with high-risk insurance costing $3,340 or more. Teen drivers receive the highest rates at $5,732 a year or more.

Annual premium for full coverage: $1,532

Rate estimates for 2016 Lexus IS 300 Insurance

Comprehensive $314

Collision $618

Liability $442

Rate data is compiled from all 50 U.S. states and averaged for all 2016 Lexus IS 300 models. Rates are based on a 40-year-old male driver, $500 comprehensive and collision deductibles, and a clean driving record. Remaining premium consists of UM/UIM coverage, Medical/PIP, and policy fees.

Price Range by Coverage and Risk

For a driver in their 40's, prices range go from as low as $496 for just liability insurance to the much higher price of $3,340 for a driver who has had serious violations or accidents.

Liability Only $496

Full Coverage $1,532

High Risk $3,340

View Chart as Image

These differences highlight why everyone should compare prices for a specific zip code and risk profile, instead of using price averages.

Use the form below to get rates for your location.

Enter your zip code below to view companies based on your location that have cheap auto insurance rates.

Recommended Companies for Cheap 2016 Lexus IS 300 Insurance

Searching Companies

Want the cheapest insurance rates for your Lexus IS 300? Trying to find the cheapest insurance for a Lexus IS 300 can turn out to be difficult, but you can learn the following methods to make it easier.

There are more efficient ways to shop for insurance and you need to know the best way to price shop coverage on a Lexus and get the lowest possible price from both online companies and local agents.

Affordable auto insurance rates with discounts

Auto insurance is not inexpensive, but there could be significant discounts that could help you make your next renewal payment. Certain credits will be shown when you get a quote, but less common discounts must be inquired about in order for you to get them.

- College Student – Children who attend college more than 100 miles from home and do not have a car may be able to be covered for less.

- Organization Discounts – Joining qualifying employment or professional organizations may earn a discount on your next renewal.

- Theft Deterent – Anti-theft and alarm system equipped vehicles are stolen with less frequency and that can save you a little bit as well.

- Student Discount for Driver Training – Reduce the cost of insurance for teen drivers by having them successfully complete driver's ed class if it's offered in school.

- Defensive Driver – Participating in a class that teaches safe driver techniques can save you 5% or more if your company offers it.

- Multi-line Discount – Select insurance companies reward you with a lower price if you buy some life insurance in addition to your auto policy.

- Save with a New Car – Putting insurance coverage on a new car can be considerably cheaper since newer models are generally safer.

A little disclaimer on discounts, most of the big mark downs will not be given to the overall cost of the policy. The majority will only reduce specific coverage prices like liability and collision coverage. Just because you may think all the discounts add up to a free policy, you aren't that lucky. But all discounts should definitely cut the amount you pay for coverage.

If you would like to view companies who offer free auto insurance quotes, click here.

Where can I get low cost car insurance?

Getting low cost 2016 Lexus IS 300 car insurance pricing can be surprisingly simple. All that's required is to take a couple of minutes comparing rate quotes online with multiple companies. You can get a good selection of rate quotes in several different ways.

The recommended way to get quotes would be an industry-wide quote request form like this one (opens in new window). This style of form eliminates the need for separate quote forms to each individual car insurance company. One form compares rates from all major companies. Just one form and you're done.

A less efficient way to obtain and compare quotes online consists of going to each individual company website and request a quote. For example, let's say you need rates from GEICO, Progressive and Farmers. To get each rate you have to go to every website and type in your information over and over, and that's why the first method is more popular. To view a list of companies in your area, click here .

The final method to price shop rates to all the different insurance agencies. Doing it all online can eliminate the need for a local agent unless you prefer the trained guidance that only an agent can give. You can, however, get prices online but buy the policy through an agent.

Whichever way you choose to compare rates, double check that you are using apples-to-apples coverage limits for every company. If the quotes have different liability limits it will be very difficult to make a fair rate comparison.

Free Auto Insurance Comparison

Enter your zip code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tailor your car insurance coverage to you

When it comes to choosing adequate coverage, there isn't really a one size fits all plan. Each situation is unique.

Here are some questions about coverages that could help you determine whether you would benefit from an agent's advice.

- Am I better off with higher deductibles on my 2016 Lexus IS 300?

- Will my rates increase for filing one claim?

- How can I get high-risk coverage after a DUI?

- When would I need rental car insurance?

- Is business property covered if stolen from my car?

- Do I need motorclub coverage?

- When should I remove comp and collision on my 2016 Lexus IS 300?

- Does my insurance cover my expensive audio equipment?

- Can I drive in Mexico and have coverage?

- Is my vehicle covered by my employer's policy when using it for work?

If you can't answer these questions but you know they apply to you then you might want to talk to a licensed insurance agent. If you don't have a local agent, complete this form. It only takes a few minutes and can provide invaluable advice.

Learn about auto insurance coverages for a 2016 Lexus IS 300

Understanding the coverages of your policy can help you determine the best coverages at the best deductibles and correct limits. Auto insurance terms can be ambiguous and even agents have difficulty translating policy wording.

Insurance for medical payments

Personal Injury Protection (PIP) and medical payments coverage reimburse you for expenses for EMT expenses, doctor visits, nursing services, surgery and pain medications. They are used in conjunction with a health insurance policy or if there is no health insurance coverage. Medical payments and PIP cover you and your occupants and will also cover being hit by a car walking across the street. PIP coverage is not an option in every state and may carry a deductible

Comprehensive coverage (or Other than Collision)

This will pay to fix damage that is not covered by collision coverage. You need to pay your deductible first and then insurance will cover the rest of the damage.

Comprehensive insurance covers things like rock chips in glass, damage from getting keyed and a broken windshield. The most a auto insurance company will pay at claim time is the cash value of the vehicle, so if your deductible is as high as the vehicle's value consider dropping full coverage.

Liability insurance

Liability insurance provides protection from damage that occurs to other people or property. This insurance protects YOU from claims by other people. It does not cover your own vehicle damage or injuries.

Coverage consists of three different limits, bodily injury per person, bodily injury per accident and property damage. As an example, you may have values of 50/100/50 that translate to a $50,000 limit per person for injuries, $100,000 for the entire accident, and a total limit of $50,000 for damage to vehicles and property. Another option is one number which is a combined single limit which limits claims to one amount rather than limiting it on a per person basis.

Liability insurance covers claims like legal defense fees, funeral expenses and medical expenses. How much liability coverage do you need? That is a personal decision, but consider buying as high a limit as you can afford.

Coverage for collisions

This coverage will pay to fix damage to your IS 300 from colliding with a stationary object or other vehicle. You have to pay a deductible and the rest of the damage will be paid by collision coverage.

Collision can pay for claims such as colliding with another moving vehicle, crashing into a building, colliding with a tree, sustaining damage from a pot hole and rolling your car. Collision coverage makes up a good portion of your premium, so you might think about dropping it from lower value vehicles. Drivers also have the option to choose a higher deductible to bring the cost down.

Uninsured Motorist or Underinsured Motorist insurance

Your UM/UIM coverage gives you protection when other motorists either are underinsured or have no liability coverage at all. Covered losses include injuries to you and your family as well as damage to your Lexus IS 300.

Since a lot of drivers carry very low liability coverage limits, their liability coverage can quickly be exhausted. For this reason, having high UM/UIM coverages is a good idea. Usually your uninsured/underinsured motorist coverages are identical to your policy's liability coverage.

Get your money's worth

We covered quite a bit of information on how to lower your 2016 Lexus IS 300 insurance car insurance rates. The key concept to understand is the more providers you compare, the higher your chance of finding cheaper auto insurance. You may even discover the best car insurance rates are with a company that doesn't do a lot of advertising.

When buying insurance coverage, don't be tempted to buy less coverage just to save a little money. Too many times, an insured dropped collision coverage and discovered at claim time that it was a big mistake. The proper strategy is to get the best coverage possible at an affordable rate, but do not sacrifice coverage to save money.

Some insurance companies may not have online quoting and usually these smaller providers only sell through independent agencies. Low-cost 2016 Lexus IS 300 insurance can be purchased both online and also from your neighborhood agents, and you should compare price quotes from both in order to have the best chance of saving money.

Additional insurance coverage information is located at these links:

- Child Safety FAQ (iihs.org)

- What is Full Coverage? (Allstate)

- Rental Car Insurance Tips (Insurance Information Insitute)

- Teen Driving and Texting (State Farm)

- Determing Auto Insurance Rates (GEICO)

- Auto Crash Statistics (Insurance Information Insitute)

Use our FREE quote tool to compare rates now!

How Much Car Insurance Cost on a Lexus 2016

Source: https://www.quoteinspector.com/2016-lexus-is-300-insurance-rate-quotes/

0 Response to "How Much Car Insurance Cost on a Lexus 2016"

Post a Comment